*Update* If you need to get incorporated we have set up a separate site for you to do so quickly and easily at the least expensive price possible, we are here to help you build business credit not make money on simple incorporation services. Please See CorpComply.com

What business structures are available for your business?

Sole Proprietorship

The simplest form of business in which a sole owner and his business are not legally distinct entities; the owner is usually liable for business debts.

General Partnership

A partnership in which there are no limited partners, and each partner has managerial power and untitled liability for partnership debts.

Limited Partnership

The limited partnership has limited and general partners. The general partners manage the business and are individually liable for the debts of the partnership. The limited partners are limited in the amount they can lose by the amount of money they invested in the partnership.

S-Corporation

A corporation that is eligible, and does elect to be taxed under the Subchapter S of the Internal Revenue Code. Basically, shareholders pay tax on the corporation's income by reporting their pro rate shares of pass-through items on their own individual income tax returns.

C-Corporation

A corporation is an organization authorized by state law, to act as a legal entity distinct from its owners. A corporation has it's own name, and has it's own powers to achieve legal purposes, and therefore, is a separate legal entity.

Limited Liability Company (LLC)

The LLC is a hybrid between a corporation and a limited partnership. LLC's provide protection from personal liability, just as corporations do, and yet LLC's receive the tax treatment of limited partnerships, or a C corporation, whichever the members of the LLC desire.

Business Structures

The best structure for building business credit is one that will:

The business structures that will do this are:

This is not to say that building business credit can not be accomplished with a sole proprietorship or partnership but in the end it will be limited.

Benefits of a corporation

The benefits of a S corporation, C corporation or LLC:

When is the best time to incorporate?

The best time to incorporate is when your business:

(The above criteria is only a guideline)

Business Structures

When to use a S Corporation:

When to use a C Corporation:

When to use a Limited Liability Company (LLC)

Corporate Compliance Network, Inc.

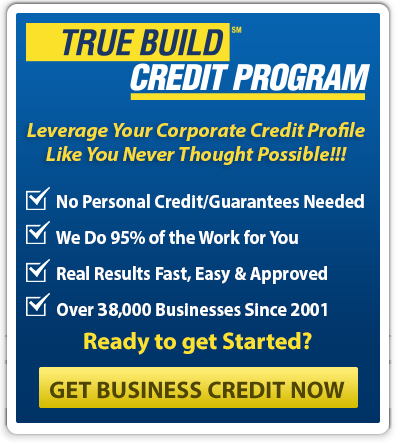

For a simple $48 (Plus state filing fees) as a member of TrueBuild Corporate Credit Program...

To learn more login to the members area or click CorpComply.com