When it comes to non-personally guaranteed business credit, a well built Experian Business report will be your company's most valuable asset for getting access to capital. Your Experian Intelliscore is what major underwriters will want to look at, and it takes more than just 3 bills paid on time to get it where it needs to be.

With over 18 years of experience in getting small businesses real results, we know exactly how these reports need to look to get approvals. Whether it's updating old information that's dragging the score down, merging duplicate credit reports, or getting your company approved for more accounts that actually report to Experian, we will help you paint the best picture possible to prepare your company for future lending needs.

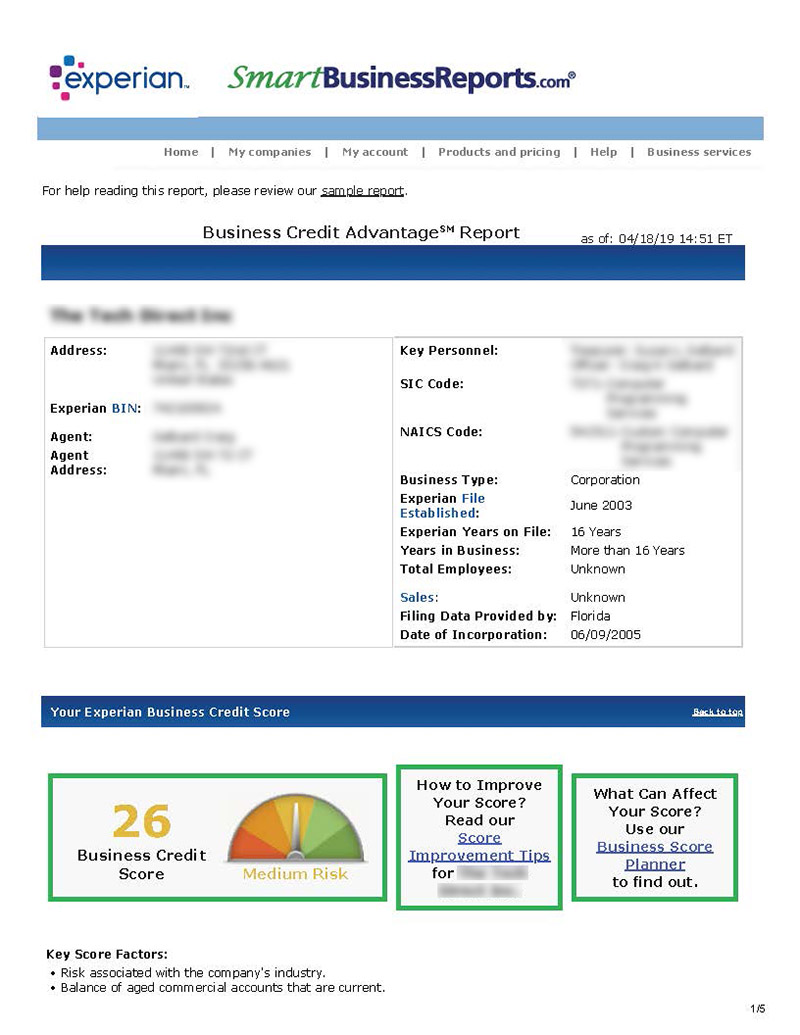

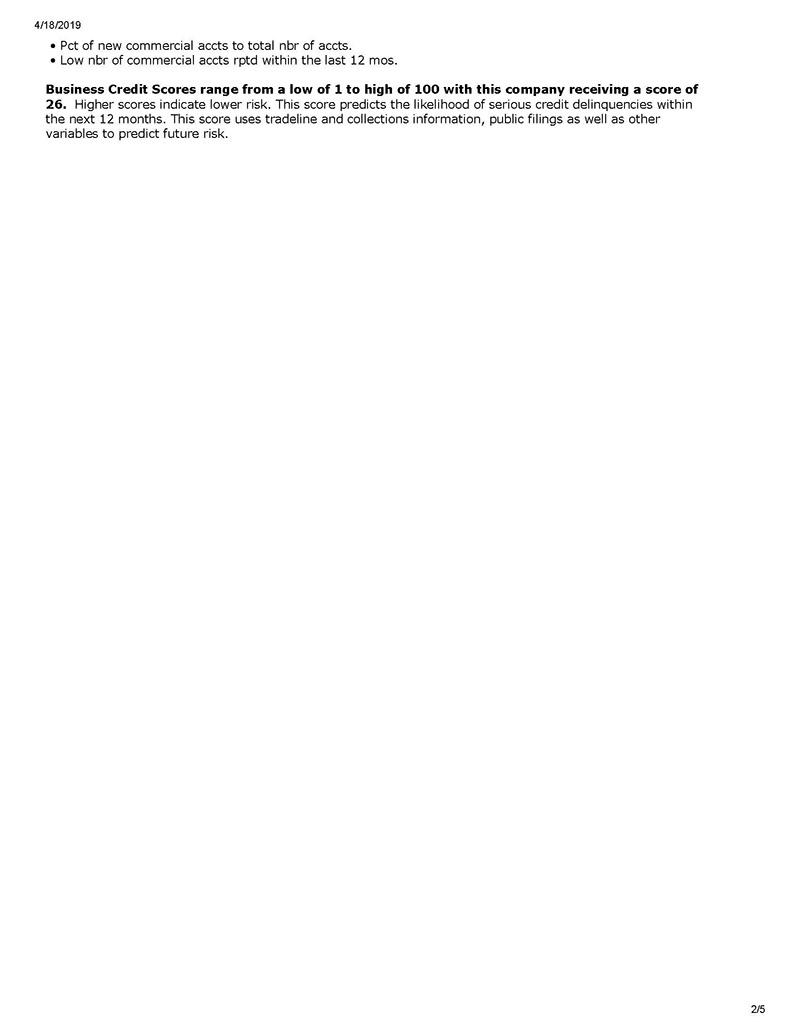

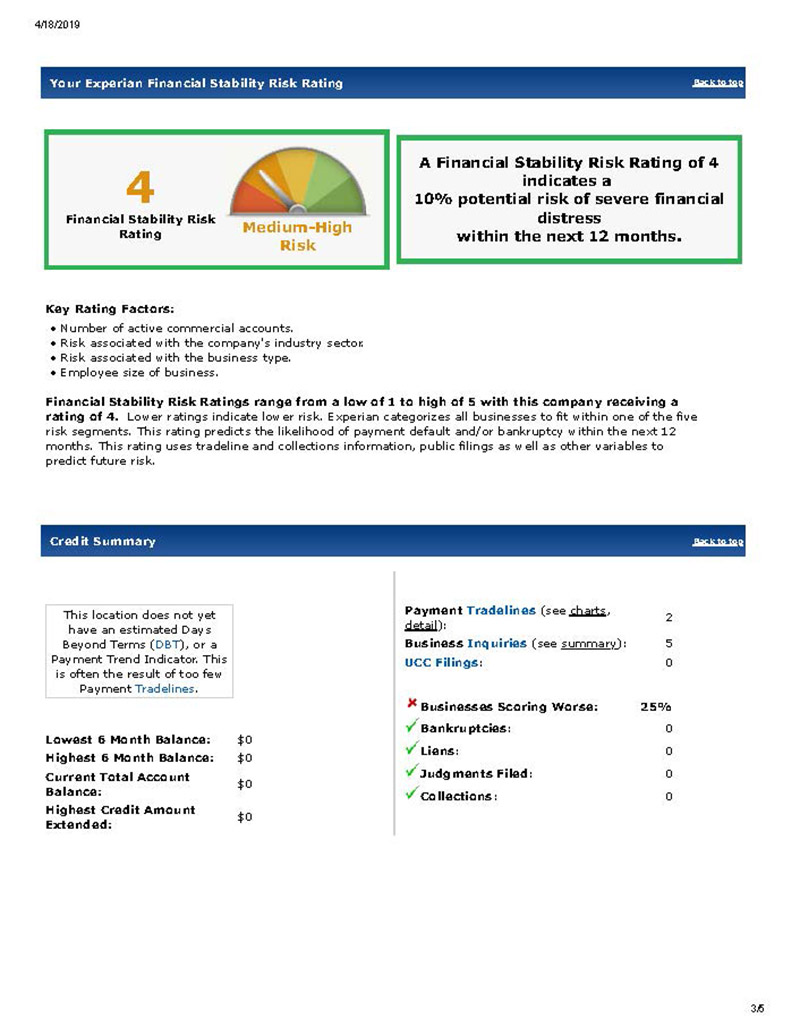

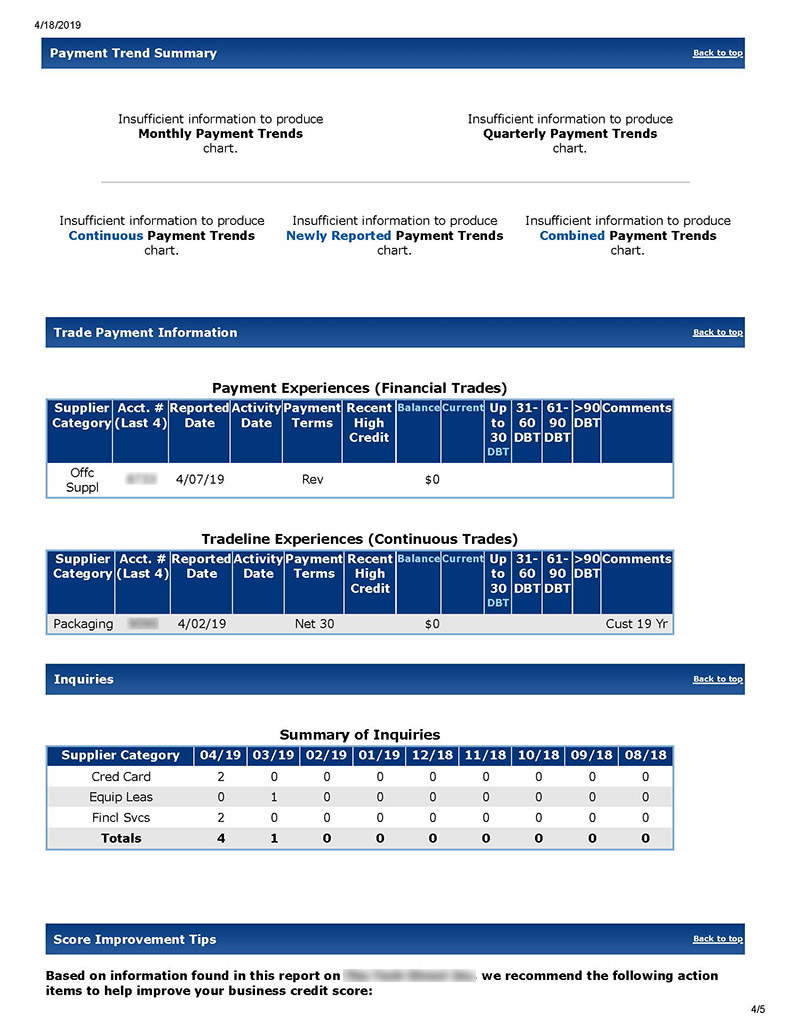

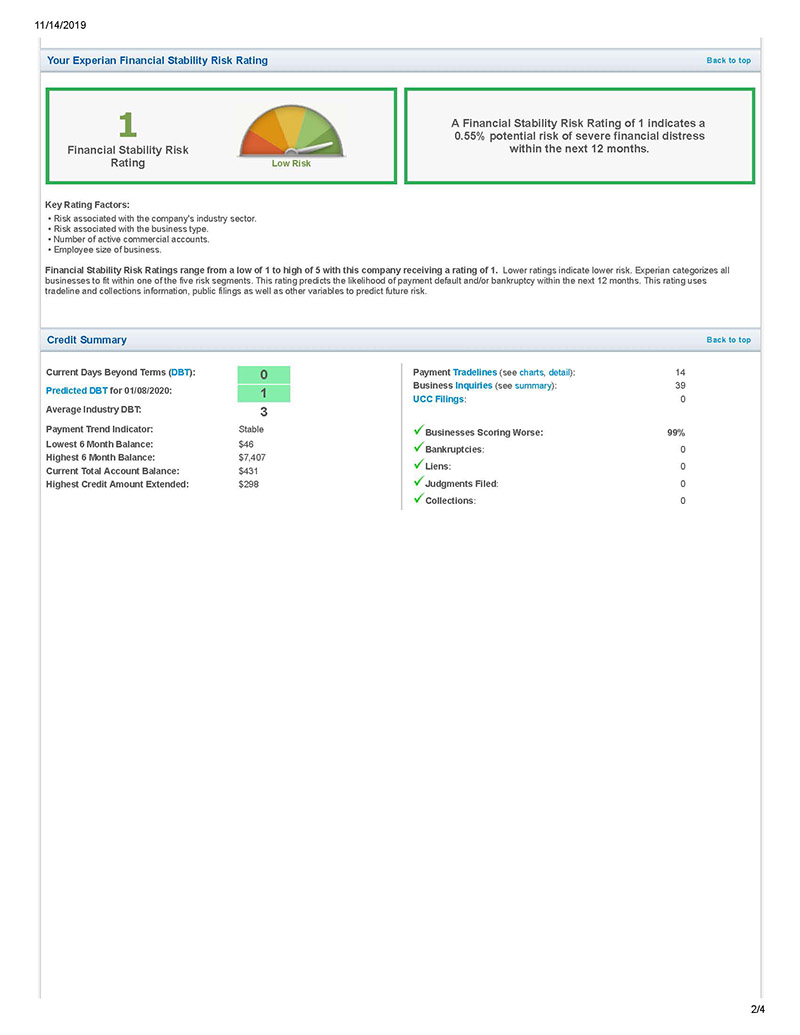

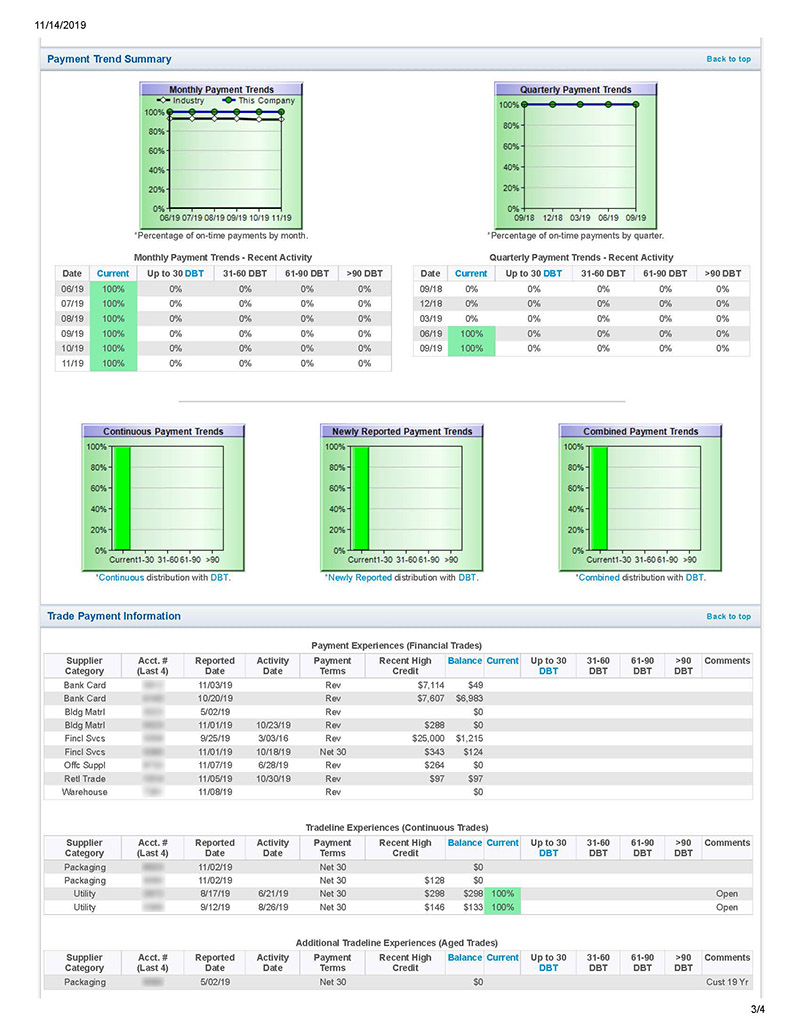

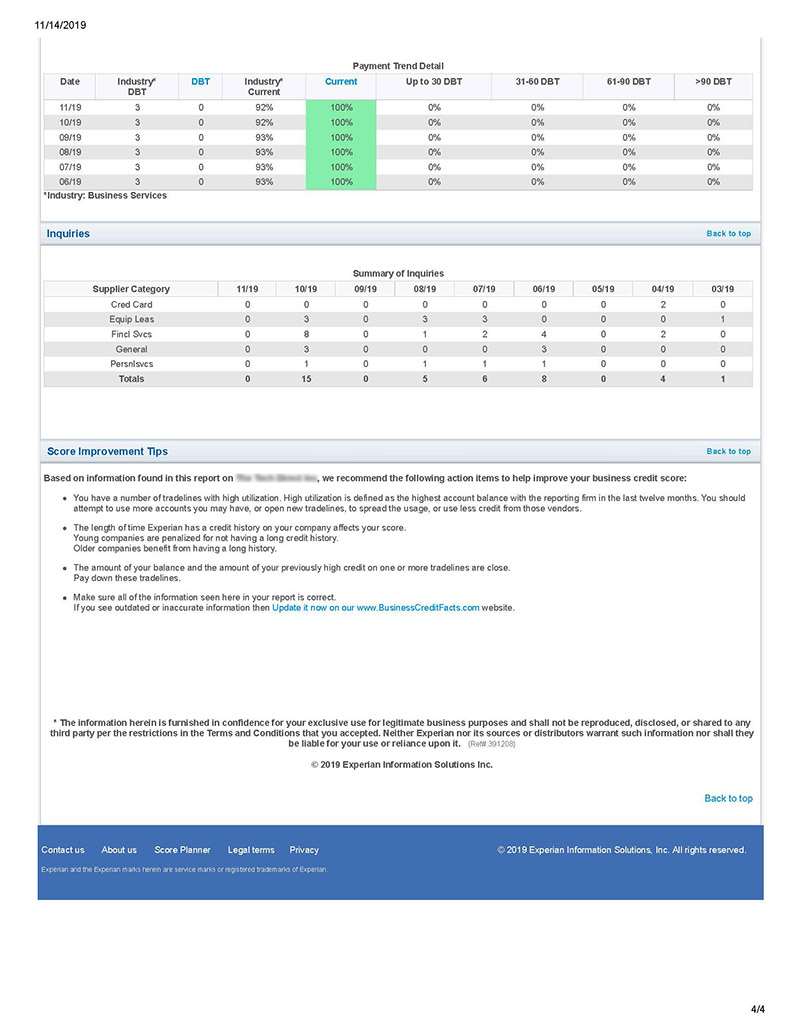

Here we can see what a typical Experian Business credit report will look like for a start up with a few NET-30 accounts already set up. The main factors that are dragging the score down are:

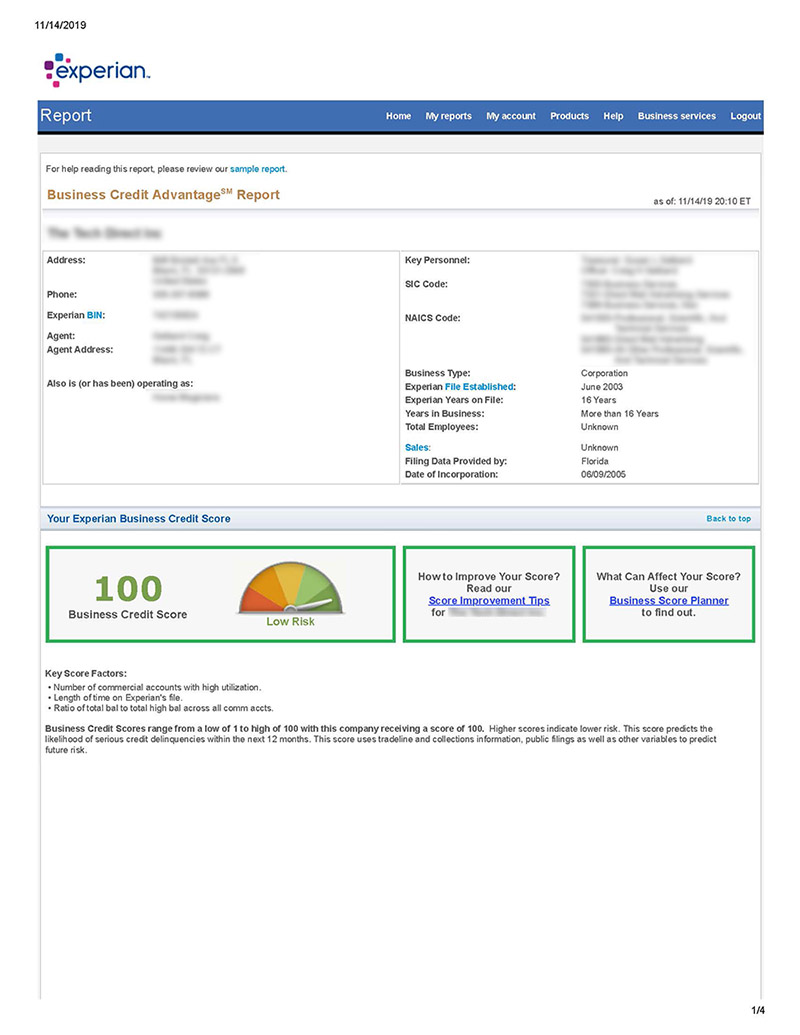

This is what lenders want to see when considering you company for credit and it is the result clients can expect with TrueBuild. Getting a result like this is nearly impossible for someone who's trying to figure out how to do it themselves. At TrueBuild, We know exactly what it takes to get your company's Experian report to this place.